21 Mar

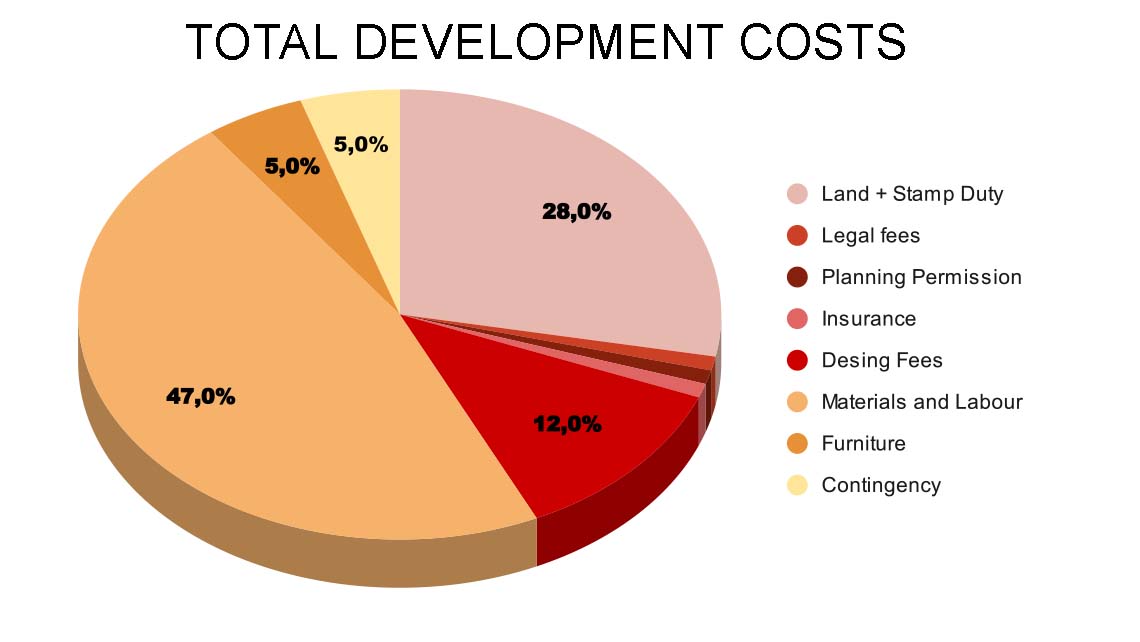

There are many factors that will contribute to the final price of a self-build project. Ultimately, the price to build a house will be influenced by the location, the materials chosen, the scale of labour involved, the land you are building on and many other elements. Some of the key costs are broken down below. We will then analyse these in greater detail straight after:

Land Acquisition with Stamp Duty and Legal Fees (25% to 40 %of total costs) VAT (10 % to 17 %) Planning Fees (1 %) Insurance (1%) Design Fees (10 % to 15%) Materials Costs and Labour Fees (40 % - 60 %) Furniture Fixture and Equipment (5 %) Contingency (5% to 10% on top - recommended)

One of the major cost that you will incur initially is to Buy the Land. Which can be from 25 up to 40 % the total cost of your building depending on the land size and on the area in which you are planning to build. When you are establishing your budget remember to set aside also the Legal Fees (usually between £ 500 and £ 1,000) and the Stamp Duty Tax. In addition to these last fees, A Site Surveyor is usually needed and would cost you around £ 300, and even Planning Permission needs to be counted if not included with the land and its cost is usually below £ 500. To find out the price per square meter on the area of your interest you better do an online research first, on websites like www.rightmove.co.uk or www.plotsearch.co.uk

Then for a more accurate research we recommend to contact a Real Estate Agent, and check out on Auction Houses.

The Price of the Land is typically valued using a residual approach. Referring to comparable recent transaction in the area the developer is usually able to estimate the new build achievable price. At a very basic level we can so considerate that the price of the land would be the price of the finished development minus the allowance for the builder profit.

Basically it is because of this formula that the price of a land in a residential area in London or a rural area in the North of England can be very different. In London in fact the development value would be much higher, while the profit will remain the same percentage and the building costs would be only slightly higher instead.

While usually death and taxes are inevitable, as the government incentivises real estate investors and people in general to be home owners, you may find below few categories that if not completely exempt from Taxes, at least have to pay less VAT than usual.

You can apply for a VAT refund on building materials and services if you’re: building a new home converting a property into a home building a non-profit communal residence - eg a hospice building a property for a charity

The building work and materials have to qualify and you must apply to HM Revenue and Customs (HMRC) within 3 months of completing the work.

VAT for most work on houses and flats by builders and similar trades like plumbers, plasterers and carpenters is charged at the standard rate of 20% - but there are some exceptions.

How you report and pay VAT in the construction industry is changing from 1 October 2019. Find out what you need to do to prepare.

You may not have charges on VAT on some types of work if it meets certain conditions, including: building a new house or flat work for disabled people in their home There’s a separate guide on VAT refunds if you’re building your own home.

You may be charged the reduced rate of 5% for some types of work if it meets certain conditions, including: installing energy saving products and certain work for people over 60 renovating an empty house or flat home improvements to a domestic property on the Isle of Man Buildings that are not houses or flats You won’t be charged VAT for construction work on certain other types of building.

You will not be charged VAT on labour or building materials for work you do on a new house or flat.

NOTE: for getting to know more about taxes and self building, please visit the government site for tax guidance and the following link: https://selfbuildportal.org.uk/vat-and-sdlt/

Professional services Equipment hire, such as plant or scaffolding, Consumables, such as sandpaper or hand tools, Kitchen appliances, including those integrated, for example hob, oven, dishwasher Bedroom furniture, bathroom furniture, such as vanity units and free-standing units Carpets, curtains and blinds (unless they are integral, eg sealed in the unit) Delivery costs, when separately invoiced by a courier Separate buildings that are part of your planning permission, apart from a garage, such as a store or a detached swimming pool building Extending or renovating an existing house. Creating a separate building or annexe. Building holiday lets or a building to rent (this is business use). There is an intermediate rate of VAT (5%) which applies to some works, for instance turning a house into flats, or flats into a house, or for work on a house unoccupied for more than two years. But the work cannot be done on a self-build basis — you have to employ a VAT registered contractor. Listed buildings have some very complex VAT rules — refer to HMRC.

Planning Fees usually involve only up to 2% on your building cost being the fee usually less than £ 500. What usually scares investors off is that they do not understand the process of doing a planning application, while instead this process is usually less complicated that you would think. There are certain restrictions if you buy for example a plot in a green belt, but if your plot has already permission to built or it is located between two plots where there are already existing buildings, most probably the process becomes much more straightforward. What happens is that your architect (assisted in the most complicated cases by a planning consultant) will produce the drawings that you will need to present to the council of your interest and they would reply giving you permission to build, (or not) within 2 months time (often much sooner than that). Sometimes, they will require some additional documents or few adjustments to be made on the drawings in order to release their permission, you will have to make these adjustments and after a review, your permission will be granted.

Even if this is not mandatory, it is highly suggested that you would add a site insurance to your project from the moment you purchase the land and you become responsible for anything that happens on it. Often the builder insurance does not cover many types of damages that can happen to your building, and adding a site insurance you will be able to protect your investment and get peace of mind for many aspects that can go wrong during construction, like a theft of construction materials, a fire, or a flood.

If one of the labourers have a serious injury, it can seriously affect your timing schedule and site insurance will give you a compensation for this loss of time, and make sure that financing will not be an additional problem to solve.

Your progresses on site will automatically be covered and same applies to plants, the health of your site visitors, your personal belongings and even any damage to your neighbor that will appear in your party wall agreement.

Another type of insurance you should be considering is a Structural Insurance. This will regard any structural damage that can raise up at your building till 10 years after works completion. This should also be in place before starting the construction of the works as an inspection will be set up at various stages of the construction process. Another good thing about these inspections from the warranty technical professionals are that they are complying with Building Control Regulations, and on top of that, these inspections will also certify your building status for the mortgage payment releases if this happens at steps.

Most mortgage lenders will require this insurance to be in place, and even in the eventuality that you will sell the house one day, it will be easier for most mortgage lenders to found the buyer if a structural insurance has been in place.

The Design fees are usually estimated between 10% and 15% of total cost. These include the Architect Fee (which is usually 8% of the cost of the building for new houses), the Structural Engineer Fee, and the Building Control Fee which checks that the works is carried on properly, and in accordance with the council regulations.

Of course the design usually plays also the most important role as all the other costs of your building will be hugely affected by it. From the way your structure will stand up, if using wood or steel for example, from the thickness of your walls to the materials of the roof and so on.

Make sure that you let your designer know about your total budget and that you tell him to draw a house that will be affordable for you. Ask him about the tasks he will be carrying for you, all expected drawings and specification, if he will manage the work till completion and how much will he charge the extra if you will need his expertise on site later on, in case management won’t be included.

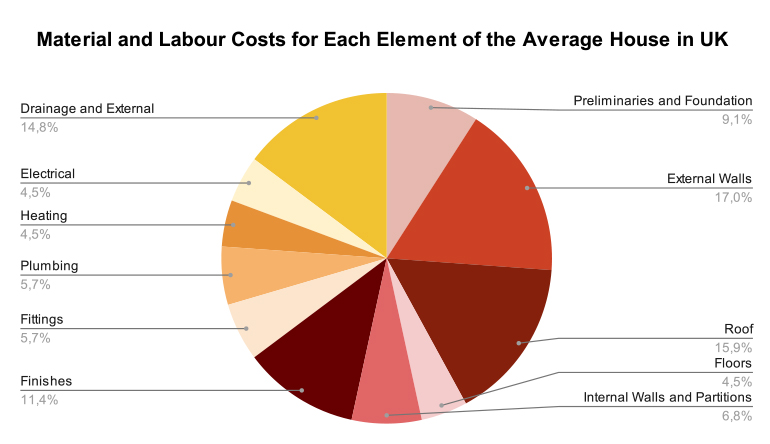

We put these two costs as one, as more and more often builders tend not to give a break down of their costs. This to protect themselves as they may end up losing a bit of money in some part of their quote, and make most of their profits in other parts, however they should really be two separate entities, especially for Self Build, in case your involvement in the project wants to be higher than usual, purchasing part of the items or even help fitting few of these.

Usually Materials are 35 - 40% of the cost while 60 - 65 % is represented by labour and fitter, the material percentage cost usually goes up for luxury homes having to deal with more expensive finishes, if not for the structure, at least for the visible part of the house.

On the next image you will see more in detail the break down of cost for every single elements of your house, considering materials and labour costs.

Of course it is worth to be aware of the fact that if you are able to purchase the materials yourself or even better to carry on some part of the works yourself this will result in huge savings for your wallet. The final price of the house can in fact go down up to £ 1,000 per square meter depending on the tasks you might feel confident on taking yourself.

Many Self Build projects end up with a small amount of budget available for the furniture.

It is true that once the other elements of the house are built, the furniture can be replaced in a second time, but it is also true that in an optimal design process, every single element should be at the perfect place from planning. For this reason a detailed planning with furniture specifications is always preferred like any interior designer would tell you. This is in order to allow for a more uniform style of every room of the property and will cut off the chance of getting things wrong.

It is important also to notice that an allowance of a 5% of cost of the house, for the cost of furniture and equipment is a good budget only for projects that aim to be cheap and cost effective. On the other end for luxury finishes, a more realistic margin will probably get closer in some cases even to a 20% of the total cost of the building. (There is a huge difference in price between Ikea furniture and an Italian bespoke pieces that will surely have more quality but will not be so much cost effective for its usage).

Please note that from our experience it is impossible to prevent every single cost for the development of your building. For this reason it is fundamental to allow at least 5% (of the total costs) for contingency, a 10% is surely safer.

Few costs might raise up along the construction project, from an upgrade in terms of style for window frames, to the roots of a tree that will force you to dig by hand part of the foundations. Maybe you could find out some issue during the site survey, or even during the building process, and especially if you haven’t already allowed for a proper building insurance these can all be costly experiences.

However, even if you allowed for an insurance, there is no insurance in the world that would cover you against anything, and even if it would exist, it would probably cost a fortune, so the smartest thing you can do, is set aside a small budget for any inconvenience that might raise up in time.

Landscaping gas and electricity connections Interior Designer Fee (included in our firm, but might be an extra cost in many other cases) Tree Removals or Planting Building Control Surveyor Party Wall Surveyor

Before you start thinking about the design of your House it is fundamental to make sure that your budget will be enough to carry the works to the end. The vast majority of times this implies the usage of a mortgage. How much you will be able to borrow depends of course from your circumstances, if you have any credit card that is on overdraft, being able to clear the overdraft before asking for how much you can borrow surely helps,it is worth to double check and act accordingly before starting the process.

It is important to understand that because you are building your own house you should not just look at the low interest on the money that you will borrow, but most importantly at the availability on the cash. Most mortgages in fact, release the money at stages of construction and this approach could be tricky for a number of reasons. Say for example that the lender is not fully satisfied with the way you built the foundation, this may affect your ability to borrow what you need for the rest of the process, and your agreement could be affected and changed.

Same could happen in case of a damage or a burglary during early stages especially if a good insurance is not in place.

Most Mortgages for self build will usually allow you to borrow between a 75 to 80% of your total costs.

This means that if you already own the land, it should be not a problem for you to borrow the rest of the money.

It is extremely important when you calculate the budget that you take off at least a 10% contingency, this in order to be safe for any case scenario.

The total costs of the building will then depend on many factors like the location of the plot, the construction method, the interior finishes.

Make sure when you set up your borrowing schedule that you will have aside the money for the main costs in advance, like for example the timber frame (if you are using that construction method) that will need to be paid in full before delivery for most suppliers and fitters.

Leave a Comment